How Pacific Prime can Save You Time, Stress, and Money.

Table of ContentsAbout Pacific PrimeGet This Report about Pacific PrimeWhat Does Pacific Prime Do?The Greatest Guide To Pacific PrimeSome Known Questions About Pacific Prime.

Your agent is an insurance specialist with the expertise to assist you through the insurance procedure and assist you discover the very best insurance security for you and the individuals and points you appreciate many. This article is for informative and pointer purposes only. If the plan insurance coverage summaries in this article problem with the language in the plan, the language in the plan applies.

Insurance policy holder's fatalities can additionally be contingencies, specifically when they are considered to be a wrongful fatality, in addition to residential property damage and/or damage. Because of the unpredictability of stated losses, they are labeled as contingencies. The insured individual or life pays a premium in order to obtain the advantages guaranteed by the insurance provider.

Your home insurance policy can aid you cover the damages to your home and manage the price of rebuilding or repair work. Sometimes, you can additionally have insurance coverage for items or valuables in your home, which you can then buy replacements for with the money the insurance provider offers you. In case of a regrettable or wrongful fatality of a sole income earner, a family members's economic loss can potentially be covered by particular insurance policy strategies.

Not known Factual Statements About Pacific Prime

There are numerous insurance coverage plans that include financial savings and/or financial investment plans along with normal protection. These can assist with structure savings and wealth for future generations using routine or reoccuring financial investments. Insurance can assist your household maintain their standard of living in case you are not there in the future.

One of the most basic type for this type of insurance, life insurance policy, is term insurance coverage. Life insurance policy generally helps your household become protected financially with a payout quantity that is given up the event of your, or the plan holder's, death during a certain plan period. Kid Strategies This sort of insurance policy is generally a cost savings instrument that aids with generating funds when children reach particular ages for going after college.

Home Insurance policy This type of insurance coverage covers home damages in the events of accidents, natural calamities, and incidents, in addition to other similar occasions. maternity insurance for expats. If you are looking to seek settlement for crashes that have actually happened and you are struggling to determine the correct course for you, connect to us at Duffy & Duffy Law Office

The Facts About Pacific Prime Revealed

At our law company, we understand that you are going with a whole lot, and we recognize that if you are coming to us that you have actually been through a great deal. https://href.li/?https://www.pacificprime.com/. As a result of that, we supply you a complimentary appointment to discuss your issues and see exactly how we can best help you

Since of the COVID pandemic, court systems have been closed, which negatively influences auto accident situations in a significant method. Again, published here we are right here to aid you! We happily offer the people of Suffolk Area and Nassau Area.

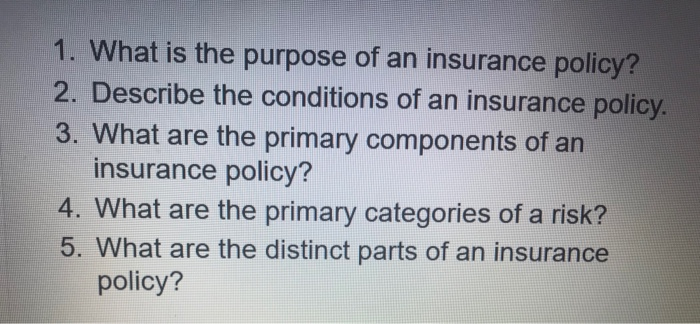

An insurance plan is a lawful agreement in between the insurance provider (the insurance company) and the person(s), service, or entity being insured (the insured). Reading your plan helps you verify that the plan meets your demands which you understand your and the insurer's responsibilities if a loss happens. Lots of insureds acquire a policy without recognizing what is covered, the exemptions that eliminate insurance coverage, and the conditions that must be fulfilled in order for coverage to apply when a loss occurs.

It recognizes who is the insured, what risks or residential property are covered, the plan restrictions, and the policy period (i.e. time the plan is in pressure). For instance, the Affirmations Web page of an auto plan will certainly consist of the description of the lorry covered (e.g. make/model, VIN number), the name of the person covered, the costs quantity, and the insurance deductible (the amount you will have to pay for an insurance claim prior to an insurance company pays its portion of a covered insurance claim). Similarly, the Declarations Page of a life insurance plan will certainly consist of the name of the person guaranteed and the face amount of the life insurance policy policy (e.g.

Pacific Prime Can Be Fun For Anyone

This is a summary of the significant pledges of the insurer and states what is covered. In the Insuring Arrangement, the insurance firm concurs to do particular points such as paying losses for covered hazards, giving certain solutions, or accepting safeguard the insured in a liability claim. There are 2 basic types of an insuring arrangement: Namedperils coverage, under which only those risks particularly provided in the policy are covered.

The 25-Second Trick For Pacific Prime

Allrisk protection, under which all losses are covered other than those losses particularly omitted. If the loss is not omitted, then it is covered. Life insurance policy plans are generally all-risk plans. Exclusions take coverage away from the Insuring Arrangement. The three significant types of Exclusions are: Left out perils or root causes of lossExcluded lossesExcluded propertyTypical examples of omitted perils under a house owners policy are.